Five years after the economic meltdown: Riches for some, poverty for the rest

Last man standing.

By Rupen Savoulian

October 5, 2013 – Links International Journal of Socialist Renewal/Antipodean Atheist -- Five years ago, in September 2008, the giant investment bank Lehman Brothers collapsed, filing for bankruptcy. This was the largest, but not the only, banking and investment firm to go under in that year, signalling the beginning of the ongoing capitalist economic crisis. Bear Sterns, Fannie Mae and Freddie Mac, IndyMac and a host of financial institutions went bust, were taken over by the US federal government (yes, in the United States where private corporations are venerated, banks were nationalised) and returned to private ownership or continued in different forms.

The beginning of this economic meltdown compelled the national bourgeoisies of the worst hit economies – namely the United States and Britain – to take steps to alleviate the crisis and rescue the capitalist system. Austerity packages were applied in the countries that experienced severe economic downturn, measures that forced the working class to accept lowered pay levels, an erosion of working conditions and removal of pensions and job security, while the top 1 per cent of the social pyramid preserved its wealth. In the United States, the Barack Obama administration passed a series of stimulus packages designed to hand over public money to the ailing investment banks and financial institutions. Corporations such as Citigroup, Merrill Lynch and other privately owned hedge funds so that they could continue their predatory financial practices.

The economic crisis has meant a huge drop in employment. Back in 2009, the CNN Money outlet reported that millions of jobs were lost as a result of the economic meltdown. The normally corporate-friendly mouthpiece Sky News reported in February 2013 that in the United Kingdom, 3.7 million jobs were lost since the start of the great recession. Less employment opportunities has meant a staggering rise in unemployment, less secure jobs and more temporary work for employees. Being unemployed or underemployed is becoming a more common feature of working life in the crisis-wracked capitalist states.

The Wall Street Journal, the lapdog of the US financial elite, reported earlier in September 2013 about the upcoming "Lost Generation" – the high schoolers from 2008 who lived through the economic downturn and are now struggling to find work. The article, entitled “Wanted jobs for new ‘lost’ generation”, details the plight of young people, their diminishing prospects for secure employment, their resultant financial difficulties and increasing student debt that is now part of the life of new college graduates. The economic and social stagnation of an entire generation puts paid to the myth of upward social mobility in a capitalist system. As Gary Lapon explained in article published in the Socialist Worker online magazine;

ONE OF the biggest myths about the United States is that it’s a mostly “middle class” society, with poverty confined to a minority of the population.

The reality is exactly the opposite: The vast majority of people in the United States will experience poverty and economic insecurity for a significant portion of their lives.

Lapon summarises the findings of various economic surveys and statistical analyses that accurately portray the life of the majority of people in the United States that experience economic immiseration. As Lapon explains:

Around four out of every five people in the U.S. will endure unemployment, receive food stamps and other forms of government aid, and/or have an income below 150 percent of the official poverty line for at least one year of their lives before age 60.

Long periods of unemployment are not just economically devastating, but also have a deleterious impact on mental health, contributing to bouts of depression and anxiety, higher levels of admissions to mental hospitals, and also a rise in chronic diseases such as cardiovascular disease and hypertension. Lapon cites a study by researchers at the University of Queensland who examined the harmful effects of family unemployment on child cognitive development. Children from unemployed families and living in poverty experience diminished levels of cognitive development, according to the researchers.

However, the wealthiest 1 per cent of the US population has amassed enormous amounts of wealth, enough to feed millions of hungry and impoverished people. The combined wealth of the richest US oligarchs is more than enough to fund education programs, food kitchens and social welfare for the poorest families. As Lapon explains in his article:

The 400 richest Americans, with a total net worth of $1.7 trillion as of last year, were worth an average of $4.2 billion each, enough to support over 89,000 families of four at 200 percent of the poverty level for an entire year.

However, the wealthiest and largest corporations are doing well during this crisis. In fact, the Obama administration has done everything in its power to ensure that the richest elite retained and even increased their share of profits as a percentage of gross domestic product (GDP). Concomitantly, the share of the GDP dedicated to workers’ wages has decreased. As Forbes magazine documented in April 2012, under Obama’s watch, corporate profits have hit an all-time high, while wages have stagnated and reached an all-time low. In the third quarter of 2012, corporate earnings increased to $1.75 trillion, while workers’ wages have plummeted as a percentage share of GDP. In 2013, the picture was even starker, with Business Insider Australia reporting that corporate profit margins have hit another all-time high in the United States. One of the reasons for this surge in corporate profitability is given by the Business Insider article:

Fewer Americans are working than at any time in the past three decades. The other reason corporations are so profitable is that they don’t employ as many Americans as they used to. As a result, the employment-to-population ratio has collapsed. We’re back at 1980s levels now.

In short, our current obsessed-with-profits philosophy is creating a country of a few million overlords and 300+ million serfs.

The Huffington Post, a mouthpiece of the liberal wing of the US ruling class, published an article that detailed how corporate profits are soaring, but workers are not getting any richer. Income inequality is skyrocketing, with an average CEO from one of the largest corporations in the US earning 273 times more than his or her co-workers. It is touching to see that the author of the Huffington Post article still believes that wealth will somehow trickle down to the rest of the population, rather than tending to coagulate at the very top. The Wall Street financiers and speculators, those responsible for the current capitalist malaise, are hardly expected to be socially responsible and reform their criminal ways. In fact, in a sign that the speculator-parasites are continuing their predatory practices, pensions and public money is being looted by the big banks and financial firms in order to prop up a failing economic system.

Suffering

Behind the statistics and figures are the human stories of suffering and struggle that the 99 per cent are going through to make ends meet. Job insecurity and the threat of poverty are basic instruments that the capitalist class uses to keep working people down. In an article published in the Socialist Worker called “She gave 25 years and her life”, author Leighton Christiansen documents the life and passing of adjunct professor Margaret Mary Vojtko, who taught French at Duquesne University in Pittsburgh. As the article states:

On September 1, she passed away at the age of 83, still an adjunct. She was buried in a cardboard coffin.

Margaret Mary was, in the words of Prof. Gary Rhodes, part of a new segment of America’s working poor: adjunct professors at colleges and universities. When she was hired 25 years ago, Vojtko may as well have taken a vow of poverty–and this poverty undoubtedly hastened her death.

Like the rest of the working poor, adjuncts work part-time or full-time for low pay, are routinely denied access to health care and/or affordable health insurance, and have little or no money left after paying the bills to invest in a retirement plan, if one is even available.

Her story is becoming increasingly widespread, as education is privatised and universities become corporatised "knowledge factories". A professorship is normally associated with job security and decent pay – not anymore. Impoverishment, the lack of a decent wage, and the erosion of health benefits all contribute to stresses and strains of the life of people like the late Margaret Mary Vojtko, and hasten their demise.

As the criminal parasitism and social decay of the capitalist system become the norm, more people are realising that all the social gains of the past – the minimum wage, set working hours, paid overtime, health benefits – are being rolled back. Obama used the fifth anniversary of the 2008 financial meltdown to make the case for an economic recovery. He argued that while problems remain, the financial situation is stabilised. There is a grain of truth in this characterisation; the economy has partly stabilised, but not for the 99 per cent of us. Richard Eskow, in an article published in Common Dreams, states it plainly;

Five years after the financial crisis, it’s become increasingly apparent that the government didn’t rescue “the economy.” It rescued the wealthy, while doing far too little for everyone else.

Recovery for the rich

Obama is correct in one respect – the banking and financial system has been stabilised, in order to continue plundering the public purse and reallocate a greater proportion of the national economy to corporate profits. The economic recovery was intended to secure the privileges and position of the super-wealthy, while the rest of us, the 99 per cent, bear the burden of the costs and are economically pauperised. The vaunted recovery has been a bonanza for the financial elite, while the working class have to work longer hours, for stagnant wages, increasing cost of living and lower expectations for the future.

One of the ways in which corporate profits are maximised at the expense of workers is an increase in unpaid overtime. Unpaid overtime contributed by workers to employers increased from an estimated $72 billion in 2009 to $110 billion – or almost eight hours a week for full-time workers in Australia. This comes from a report examining the issue of overwork, and its contribution to levels of stress, depression and anxiety among the workforce. As unpaid overtime increases, the levels of stress, anxiety and poor sleep patterns increase. This has a deleterious effect on health, family life and relationships.

Emmanuel Saez, professor of economics at the University of California Berkeley and the director of the Centre for Equitable Growth, authored an extensive study into the growth of income inequality in the United States over the last five years. The study by Saez, entitled “Striking it Rich; The Evolution of Top Incomes in the United States”, elaborates how the economic recovery has benefited the already wealthy, with a massive transfer of money from the working class to the financial elite. To quote from Saez’s study;

Top 1% incomes grew by 31.4% while bottom 99% incomes grew only by 0.4% from 2009 to 2012. Hence, the top 1% captured 95% of the income gains in the first three years of the recovery. From 2009 to 2010, top 1% grew fast and then stagnated from 2010 to 2011. Bottom 99% stagnated both from 2009 to 2010 and from 2010 to 2011.

Richard Eskow, writing in Common Dreams, states that while there has been an economic recovery of sorts, it is a recovery tailored to the needs of the financial oligarchy. What we are witnessing is a rich person’s recovery, made possible by the policies of the Obama administration. Political decisions were taken to enable the recovery to be skewed in favour of maintaining current levels of inequality, and even increasing the rates of corporate profitability. As Eskow states:

A Rich Person’s Economy doesn’t just happen. It took government action to decimate the thriving middle class of the 1960s and 1970s while directing an ever-increasing stream of wealth to the already wealthy.

And further in his article:

Government efforts were largely targeted toward banks, whose earnings are primarily pocketed by the wealthy. The lack of accountability for Wall Street misconduct was interpreted (probably correctly) as license to continue their risky, wealth-accumulating behavior.

The recovery has been implemented by the political representatives of the ruling financial oligarchy to continue the criminal parasitism that resulted in the economic malaise in the first place, and take money from the public sphere, leaving the 99 per cent to struggle with diminishing resources. The defenders of the economic status quo, such as the Obama administration, are insisting on hyping up a recovery enriches a minority at the expense of the vast majority of working people. The danger resides in the fact that all of us in the 99 per cent will swallow this propaganda and believe that we will share in this recovery, and that wealth will filter down from the very-top.

Richard D. Wolff, professor of economics emeritus at the University of Massachusetts Amherst, recently wrote an article republished in Common Dreams exposing the fallacy of the recovery hyperbole, and disabusing the readers of any notion that the capitalist economy is serving the interests of the 99 per cent. As Wolff states in the introduction to the essay:

You don’t have to be a Marxist to see how the 1% tries to fool us that we too are sharing in their renewed wealth. But it helps.

Professor Wolff explains that hyping the recovery serves a specific political function; lulling the 99 per cent into a false sense of security while our wages decline and our working conditions are eroded. It also reassures the partisans of "free-market" capitalism that their dogma is sound and that the system is working. Many academically trained economists have built their careers hailing the merits and alleged superiority of the capitalist system. Critics of the capitalist, "free-market" fundamentalist dogma have long been derided as extremists and fringe dwellers, unable to grasp economic reality. The academic celebrants of capitalism, as Wolff calls them, are now reeling from the obvious breakdown of the economic system and the inadequacy of the dogma they were schooled in and defending all these years.

Paul Krugman, Nobel-Prize winning economist and regular contributor to the New York Times, penned a column in December 2012 expressing his dismay that big capital is acquiring an ever-greater share of the national pie at the expense of labour. After observing that the US economy is still in deep trouble, he asks in astonishment:

Wait — are we really back to talking about capital versus labor? Isn’t that an old-fashioned, almost Marxist sort of discussion, out of date in our modern information economy?

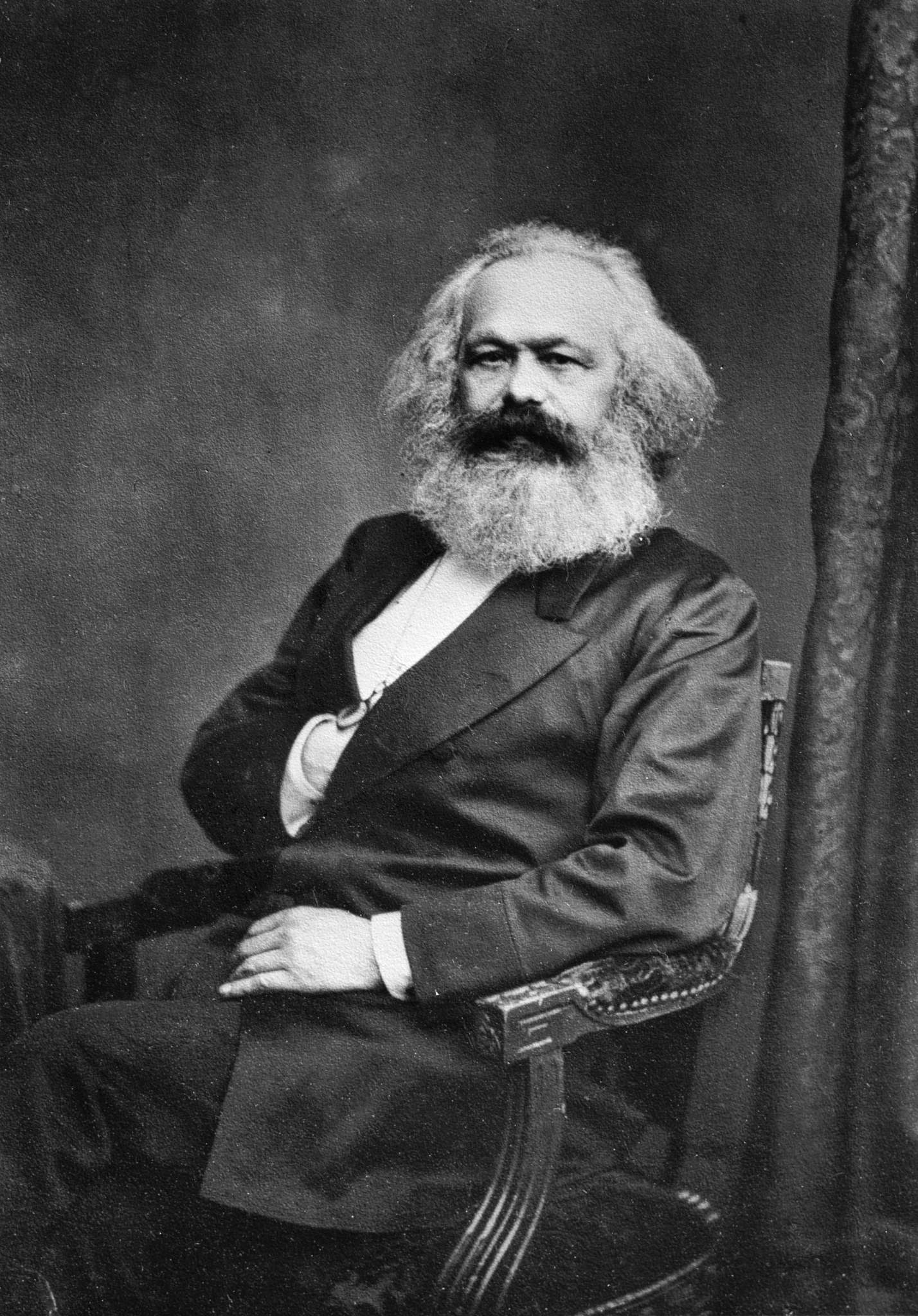

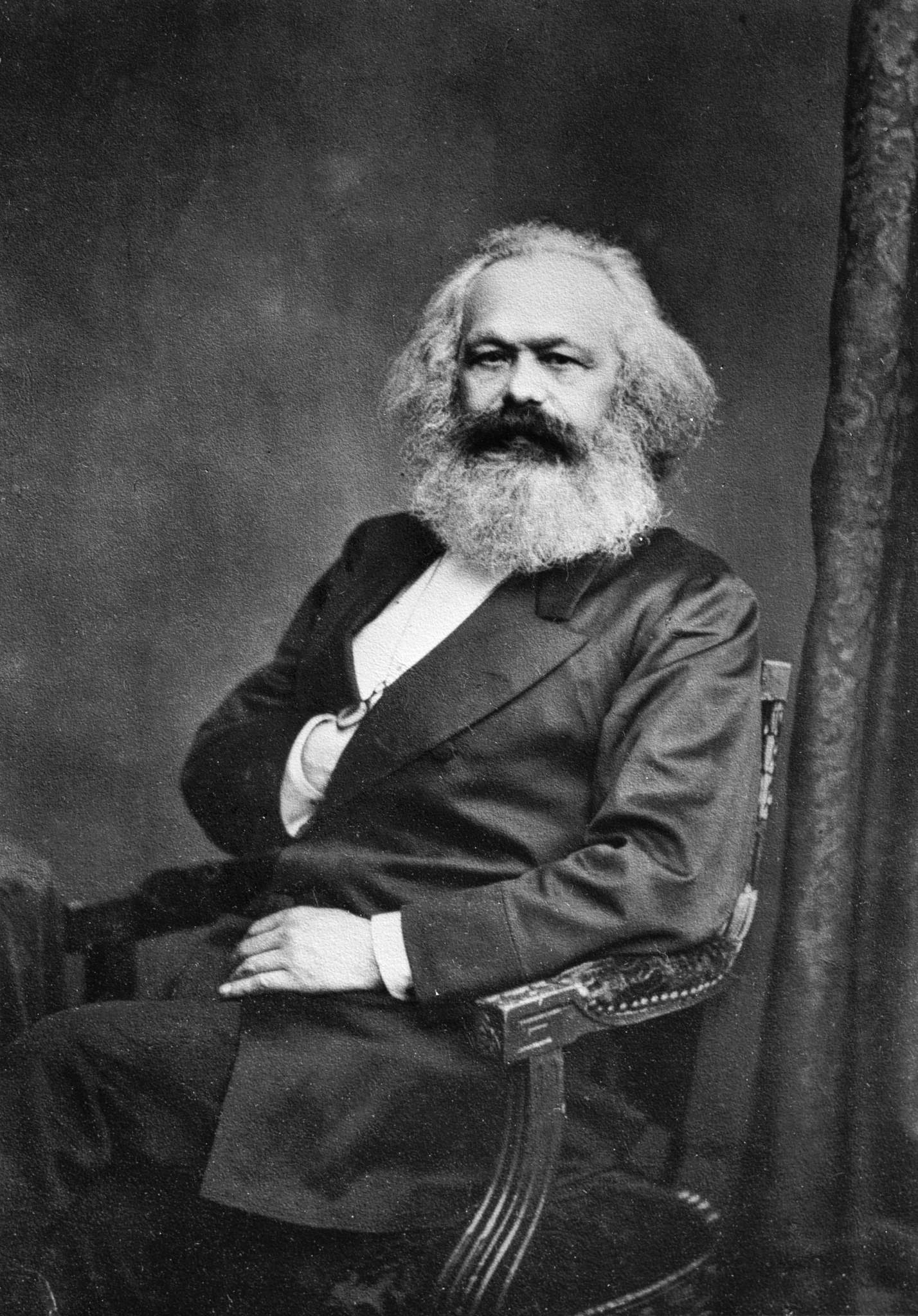

Karl Marx still relevant

Actually, the "old" Marxist categories of capital versus labour, surplus value and the alienation of the worker from the productive process and its results are all quite relevant to today. Marx elaborated on the operating mechanisms of capital, analysed the laws of motion of capital, the primacy of profit maximisation and elucidated on the intractable contradiction of capitalism; the private ownership of the means of production, but the socialised and collective nature of the productive process.

Bourgeois economists, like Professor Krugman, are slowly rediscovering Marx and the critical importance of his analysis in understanding modern capitalism. Of course, Lenin came along with an elaborated a theory of capitalist imperialism, the division of the world into rival spheres of influence controlled by the imperialist states, growing militarism and inter-imperialist rivalry, the super-exploitation of the economically colonised countries for the benefit of a handful of imperialist powers, and the domination of the world by finance capital, but it is too much to expect the celebrants of big capital to absorb all this in the one sitting, so let’s stick to Marx.

Nouriel Roubini, professor of economics at the Stern School of Business in New York University, the economist widely credited with foreseeing the economic collapse of 2008, stated in an interview back in 2011 what the servants of corporate capital dare not say out loud:

Karl Marx was right, at some point capitalism can destroy itself.

His comments, stated in an interview with the Wall Street Journal and summarised in the Australian newspaper, were part of a long and extensive interview in which Roubini surmised that all the major capitalist economies were falling into a deep recession, and that austerity programs were precisely the wrong instrument to use to recover. Professor Roubini’s warnings turned out to be prescient and perceptive, unlike the chairperson of the US Federal Reserve, Ben "I did not see it coming" Bernanke. In an article dated October 1, 2013, Roubini examines the return of the other great manifestation of the capitalist malaise, the eurozone crisis. Stimulus packages have been passed, and the immediate storm has been weathered, but beneath the surface, says Roubini, the eurozone’s fundamental problems remain unresolved. The "periphery" countries of the eurozone, Greece, Spain, Portugal, Romania, Bulgaria – are all at the epicentre of the crisis, but it is still seething beneath the surface. Roubini identifies what he calls "austerity fatigue" as the larger European economies, such as Germany and France, tire of pumping money into the coffers of the failing states.

After an enormous campaign of calumnies and defamation against him, his theories derided as obsolete and outdated, there is one philosopher and political economist who has withstood the test of time. His analysis is worthy of serious consideration. He examined how the capitalist system accumulates enormous wealth at the top end of the social pyramid, and imposes increasing pauperisation on the 99 per cent at the bottom. Knocking out the other major bourgeois-economist contenders, the last man standing, and the ultimate fighting champion is: