Bangladesh: The ‘Global South’ debt crisis intensifies

First published at Michael Roberts’ blog.

The overthrow of the Sheikh Hasina’s dictatorial government in Bangladesh by students and the populace last week is a startling outcome of the economic nightmare that many so-called developing economies are experiencing now: stagnant trade, rising debt interest costs and severe austerity being imposed by the IMF and private capital in return for ‘financial aid’.

Bangladesh was regarded as an economic success story up to the government’s fall – at least in the Western media and among mainstream economists. The IMF was forecasting that Bangladesh’s GDP would soon exceed that of (tiny) Denmark or Singapore. Its GDP per person was already bigger than neighbouring India’s. The country’s average GDP growth over the past decade, according to government statistics, was around 6.6%. As late as April this year, the World Bank reckoned that Bangladesh would grow by 5.6% this year, led by its highly successful garment industry, which relies on cheap labour sweat shops to gain market share globally. It accounts for more than 80% of the country’s exports. The government was forecasting that by 2025, Bangladeshi factories would produce 10% of the world’s apparel.

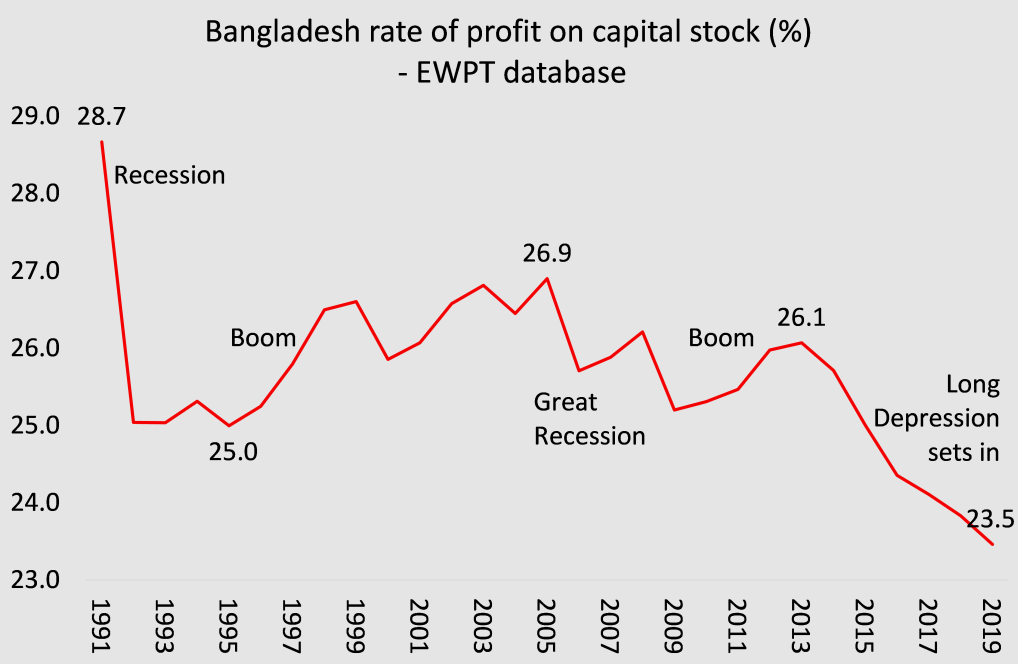

But beneath the surface, the rise of the economy was based on faltering profitability for Bangladesh capital. The relative recovery in profitability after the global Great Recession of 2008-9 began to reverse from 2013, leading up to the pandemic slump in 2020.

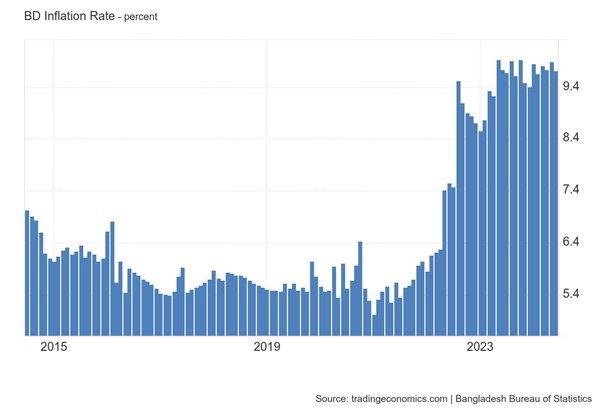

The crisis came quickly this year. Within weeks of the World Bank’s’ optimistic April report, the reality emerged: the economy was deteriorating fast. Huge infrastructure projects were failing and eating into resources, riddled as they were by corruption. Rising interest costs on borrowing, higher inflation and falling export demand drove many companies into default with over $20bn in ‘non-performing loans’. The government handed out huge subsidies (billions) to private companies to ensure electricity coverage in the country. The rich shareholders prospered and took the opportunity to siphon their wealth out of the country; while remittances from Bangladeshis working abroad fell back.

In contrast to the rich, the majority of the country’s 170m people suffered. Most Bangladeshi garment workers are women (50-80%), while the better-paid factory supervisors tend to be men. Most of the women earn just a minimum wage — 8,000 taka, or about $80 per month. With rising food prices, that’s nowhere near enough. “All daily goods like rice, eggs, vegetables — everything is getting more expensive,” said Taslima Akhter, president of Bangladesh Garment Workers Solidarity, a labour group. “Also the price of gas for cooking [at home] and electricity [in factories]. So this is a big problem for workers and the industry.”

A BBS survey conducted in the middle of 2023 revealed that around 37.7 million people experienced moderate to severe food insecurity in the country. More than a quarter of families were taking out loans to cover the cost of daily necessities, including food. A survey by the South Asia Network on Economic Modeling, a think tank, showed that 28% of households resorted to borrowing money to survive. The average amount of loans per household in the country nearly doubled between 2016 to 2022.

Bangladesh had been registering increases in life expectancy for decades. In 2020, it reached 72.8 years, the highest to date. But since then, the pattern of growth has been broken. In 2021, there was a decline to 72.3 years onwards. The mortality rate for children under five years of age, newborns, and children under one year has increased.

There has been a drop in students at the secondary-school level and an increase of NETT (not in employment, education, or training) among the youth population. According to the BSVS-2023, the share of children between five and twenty-four years not in educational institutions has risen since the COVID-19 pandemic. In 2020, at the onset of the pandemic, 28% were out of educational institutions; by 2023, the share reached 41%! Around 40% were neither in school nor in employment, up 10% pts in eight years. The student protests that brought down the government were triggered by the job quota system that reserved 30% of government jobs for families of 1971 war veterans (mainly government families). Protesters demanded the replacement of the quota with a merit-based system.

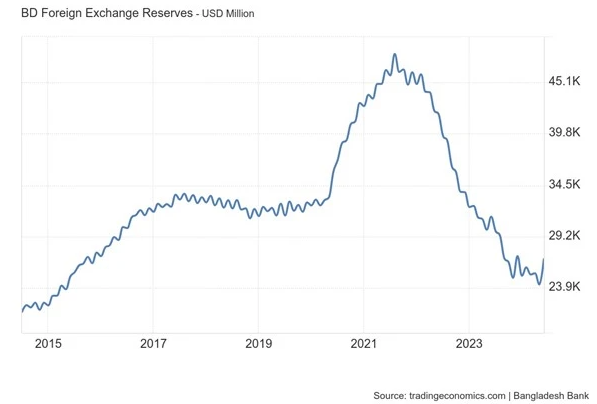

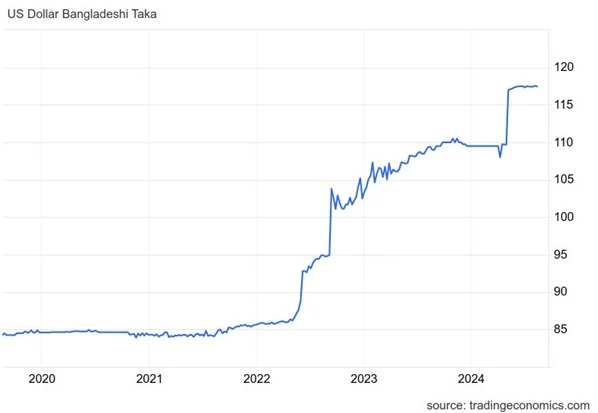

In June 2024, the IMF admitted that “stubbornly high international commodity prices and continued global financial tightening have amplified macroeconomic vulnerabilities” Foreign exchange reserves declined sharply due to interventions to prop up the Bangladesh currency , the taka. FX reserves plummeted from $46bn in 2021 to just $19bn.

The taka fell over 20% against the US dollar, driving up the costs of servicing foreign debt. The external account went into deficit by up to 4% of GDP a year.

The government was forced to turn to the IMF for ‘relief’. The IMF approved a small package of $3.3bn in early 2023. Then this year that was raised to $4.7bn designed to relieve pressure on the FX. And the IMF handed over $1.1 bn in June.

But now all is in flux. After a brutal attempt to suppress the protests with the army and police killing over 300 people, Hasina finally fled the country. A temporary government has been formed under Nobel Peace Prize winning economist Muhammad Yunus to lead an interim government. But don’t expect any improvement under his administration (read this: https://www.cadtm.org/Bangladesh-Who-is-Muhammad-Yunus-the-new-primer-minister). Yunus will again turn to the IMF for support in return for which the IMF will impose severe austerity measures.

The Bangladesh economic crisis is being repeated across the Global South – in Kenya where riots have ensued to reverse IMF-demanded tax rise; in Pakistan where the government has turned for the seventh time to the IMF for funding; in Egypt which is on the brink of default; and in Nigeria, where hunger rules. And of course, Argentina.

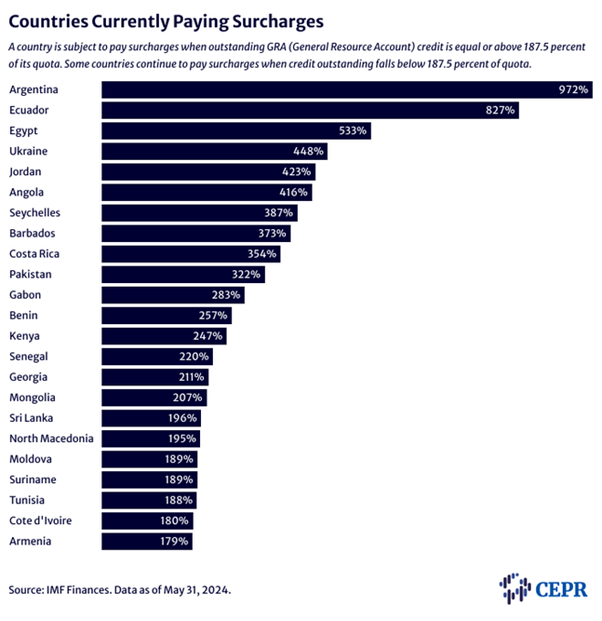

And the IMF surcharges any debtor that fails to pay on time, which only makes loan repayment harder. The number of countries paying surcharges annually has nearly tripled in 5 years, from 8 in 2019 to 23 in 2024. Over the past six years, the IMF charged $7 billion in surcharges.

Through 2033, CEPR estimates that the IMF will charge approximately $13 billion in surcharges. Argentina alone will owe an estimated $6 billion, followed by Ukraine, with a debt of nearly $3 billion. On average, surcharges will represent 26% of all charges and interest levied on surcharge-paying countries. For some borrowers, such as Costa Rica and Ecuador, surcharges will represent even more.

As a new report by the World Bank shows, the Global South is not just failing to ‘catch up’ with the Global North, but instead is falling further behind.