The doublespeak of the discredited IMF

By Eric Toussaint and Damien Millet, translated by Christine Pagnoulle and Judith Harris

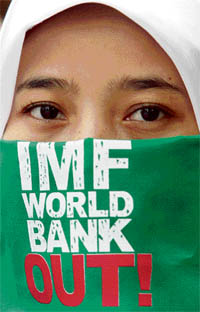

March 12, 2009 – The international crisis that erupted in the summer of 2008 demolished all the neoliberal dogmas and exposed the deception behind them. Unable to deny their failure, the World Bank (WB) and the International Monetary Fund (IMF) claim they no longer uphold the set of neoliberal policies known as the “Washington Consensus’’. Yet, discredited though they may be, these two institutions are using the international crisis to return to the limelight.

For decades they have enforced the deregulation measures and structural adjustment programs that have led to the current impasse. After this total fiasco the WB and the IMF must now account for their decisions before world opinion.

In addition, their economic forecasts are less than reliable. In November 2008 the IMF predicted 2.2% global growth in 2009, then downsized it to 0.5% in January, finally acknowledging it would be negative in March. The reality is, its experts are siding with major creditors against citizens whose fundamental rights are less and less respected.

While the economic context is fast deteriorating, the world’s big moneylenders are trying to keep the upper hand while placing a discredited and delegitimised IMF in the role of white knight – helping the poor and downtrodden to face the damage wrought by this current crisis. But the opposite is true. The principles defended by the IMF since the 1980s and denounced by the Committee for the Abolition of Third World Debt (CADTM) since its inception are still the same. Governments that sign an agreement with the IMF in order to obtain a loan must still implement the same toxic recipes that aggravate the living conditions of their country’s people.

Responding to pressure from the IMF under the leadership of Dominique Strauss-Kahn, several countries faced with the consequences of the crisis have sliced workers’ wages and social benefits. Latvia reduced its civil servants’ incomes by 15%, Hungary suppressed workers’ “13th month’’ bonus (after reducing retirement benefits as part of a previous agreement) and Romania is about to move in the same direction. The potion is so bitter that some governments are reluctant to administer it. The Ukraine recently declared the conditions imposed by the IMF to be “unacceptable’’, especially the gradual raising of the retirement age and increased housing costs.

It is high time to expose the doublespeak of the IMF and of Dominique Strauss-Kahn, who on the one hand expects the international commununity to increase its efforts to reach the unambitious Millenium Development Goals and, on the other, compel governments calling upon IMF help to reduce the salaries of their civil servants. This is the opposite of a policy genuinely aimed at facing the crisis while protecting the interests of its victims.

To respond to the crisis of the 1930s and pressured by social mobilisation, the US president Franklin Roosevelt reduced working hours while maintaining salaries, social benefits and workers’ rights, such as the right to join trade unions. With the New Deal, Roosevelt set up a tax reform that raised levies on capital. Dominique Strauss-Kahn, a so-called “socialist”, hardly measures up to Roosevelt’s stature and persists against all odds in protecting the interests of the creditors who appointed him to this handsomely paid position.

Once more the IMF is shown to be a compliant instrument in the hands of those who are responsible for the current crisis. In a period of severe monetary destabilisation (as evidenced by the huge variations in parity between the US dollar and the euro over the past year), the IMF proves incapable of implementing a tax of the Tobin-Spahn kind that would reduce exchange rate variations by controlling speculation, and that would provide the funds needed to put an end to poverty and make development possible. Since the IMF was founded in 1944, its missions explicitly include promoting full employment, which means that the institution is in breach of its own statutes.

The global economic and financial crisis highlights the failure of the deregulated financial markets and freewheeling capital flow advocated by the IMF. A new international architecture is called for, based on the International Covenant on Economic, Social and Cultural Rights (1966) and the UN Declaration on the Right to Development (1986). Yet this logic will not prevail while the balance of power remains unchanged. Unless a sufficient number of governments respond to popular pressure and set up such an alternative, the World Bank and the IMF will be able to get over the current crisis, taking advantage of falling export commodity prices to bring weakened poor countries into a new state of loan dependency, with a central aim of saving the system, and not of meeting human and environmental criteria.

For all these reasons, the only acceptable solution is the immediate abolition of the IMF and the World Bank, and their replacement by radically different institutions that focus on satisfying fundamental human needs.

[Eric Toussaint is president of the Committee for the Abolition of Third World Debt Belgium (http://www.cadtm.org), author of A Diagnosis of Emerging Global Crisis and Alternatives (Mumbai, India, Vikas Adhyayan Kendra, 2009) and The World Bank: A Critical Primer (London, UK, Pluto Press, 2008). Damien Millet is spokeperson for CADTM France. They are joint authors of 60 Questions 60 Answers on the Debt, the IMF and the World Bank (English version to be published in 2009).