economics

Venezuela: Confronting capitalism's crisis with more revolution

By Manuel Sanchez

Caracas, March 14, 2009 -- In some countries, the severe crisis of capitalism has resulted in a realignment of respective governments with the imperialist powers — and the adoption of different forms of cut backs that affect the living conditions of the majority.

In the Venezuela, the opposite is occurring.

Before and after the victory for the pro-revolution forces in the referendum on February 15, 2009, to allow elected officials to stand for re-election more than once, the decision to push forward with the transition to socialism was ratified.

The world economic situation has also undoubtedly hit hard in Venezuela. The revolutionary government has already resolved to eliminate “all expenses that are not absolutely indispensable”.

But these austerity measures, far from adversely affecting the course of the revolution that seeks to transform the country, are favouring it. To the average politically trained eye, this has been evident since September 2008. President Hugo Chavez explicitly warned of this in this annual message to the nation on January 13.

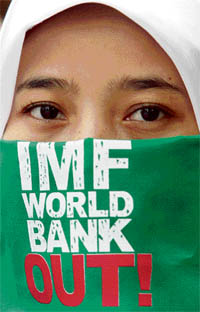

The doublespeak of the discredited IMF

By Eric Toussaint and Damien Millet, translated by Christine Pagnoulle and Judith Harris

March 12, 2009 -- The international crisis that erupted in the summer of 2008 demolished all the neoliberal dogmas and exposed the deception behind them. Unable to deny their failure, the World Bank (WB) and the International Monetary Fund (IMF) claim they no longer uphold the set of neoliberal policies known as the ``Washington Consensus’’. Yet, discredited though they may be, these two institutions are using the international crisis to return to the limelight.

For decades they have enforced the deregulation measures and structural adjustment programs that have led to the current impasse. After this total fiasco the WB and the IMF must now account for their decisions before world opinion.

Marx is back! Karl Marx and his contribution to the socialist tradition

The ideas of Karl Marx -- that class society creates great wealth for the few at the expense of the many -- ring truer every day. Brian Jones, a member of the International Socialist Organization of the United States, examines Marx's revolutionary ideas in the following three articles. These articles first appeared in Socialist Worker, newspaper of the International Socialist Organization of the United States. They have been posted at Links International Journal of Socialist Renewal with permission of Socialist Worker.

Lessons from the past: The Great Depression and the Communist Party of Australia

A section of the Wharfie's Mural, the large-scale work of art from the walls of the CPA-led Waterside Workers Federation (WWF) canteen in Sussex Street, Sydney, in the 1950s and '60s.

By Dave Holmes

[This is an excerpt from the new pamphlet, Meltdown! A socialist view of the capitalist crisis, by Resistance Books. Meltdown! features essays by John Bellamy Foster, Phil Hearse, Adam Hanieh, Lee Sustar and others. Purchase a copy from Resistance Books.]

The current economic crisis is a fundamental crisis of the world capitalist system. British socialist Phil Hearse calls it the “third slump” in the history of the capitalism (the other two being the Great Depression of the 1930s and the 1974-75 sharp downturn). And the levels of mass distress may yet come to rival the 1930s.

Market madness: `Oversupply' of water tanks during a record water crisis!

By Dave Holmes

Melbourne, February 26, 2009 -- Australian plastics manufacturer Nylex has been placed in the hands of receivers. Nylex is a well-known name — the company produces the iconic Esky, water tanks, wheelie bins, hose and garden fittings and interior trimmings for car manufacturers. According to the February 13 Melbourne Age, “The drought and a government rebate stimulated demand for water tanks, but oversupply pushed down prices and demand collapsed after substantial rain in Queensland and NSW.”

The slump in the auto industry also contributed to the company’s woes. In the end, the banks (ANZ and Westpac) called in their loans.

The jobs of its 700-strong work force are in the balance. The receivers may or may not find a buyer for Nylex, but any new owner is likely to heavily restructure the company, leading to substantial job losses.

By John Bellamy Foster

John Bellamy Foster is editor of Monthly Review and professor of sociology at the University of Oregon. He is coauthor, with Fred Magdoff, of The Great Financial Crisis: Causes and Consequences (Monthly Review Press, January 2009) among numerous other works. This article was originally a presentation delivered to the International Conference on the Critique of Capital in the Era of Globalization, Suzhou University, Suzhou, China, January 11, 2009. It appeared in the March edition of Monthly Review and is posted at Links International Journal of Socialist Renewal with John Bellamy Foster's permission.

John Bellamy Foster: `A whole different kind of struggle is emerging'

John Bellamy Foster is editor of Monthly Review and professor of sociology at the University of Oregon. He is the coauthor with Fred Magdoff of The Great Financial Crisis: Causes and Consequences, recently published by Monthly Review Press. This interview was conducted by Mike Whitney and first appeared at Dissident Voice. It has been posted at Links International Journal of Socialist Renewal with Whitney's permission.

By Michael A. Lebowitz

[Michael Lebowitz will be a featured guest at the World at a Crossroads conference, to be held in Sydney, Australia, on April 10-12, 2009, organised by the Democratic Socialist Perspective, Resistance and Green Left Weekly. Visit http://www.worldATACrossroads.org for full agenda and to book your tickets. Find other articles by Michael Lebowitz HERE.]

Economic crisis: Skyrocketing unemployment in Asia hits women and young people hardest

By Reihana Mohideen

[Reihana Mohideen will be a featured guest at the World at a Crossroads conference, to be held in Sydney, Australia, on April 10-12, 2009, organised by the Democratic Socialist Perspective, Resistance and Green Left Weekly. Visit http://www.worldATACrossroads.org for full agenda and to book your tickets.]

February 23, 2009 -- Recent International Labour Organisation (ILO) reports on global and regional employment trends paint a stark picture of rapidly increasing unemployment in 2008; the situation is expected to worsen in 2009 with the prediction of massive job losses. The message is clear: workers and the poor are already paying heavily for the capitalist economic crisis. Especially hard hit are working-class and poor women and young people.