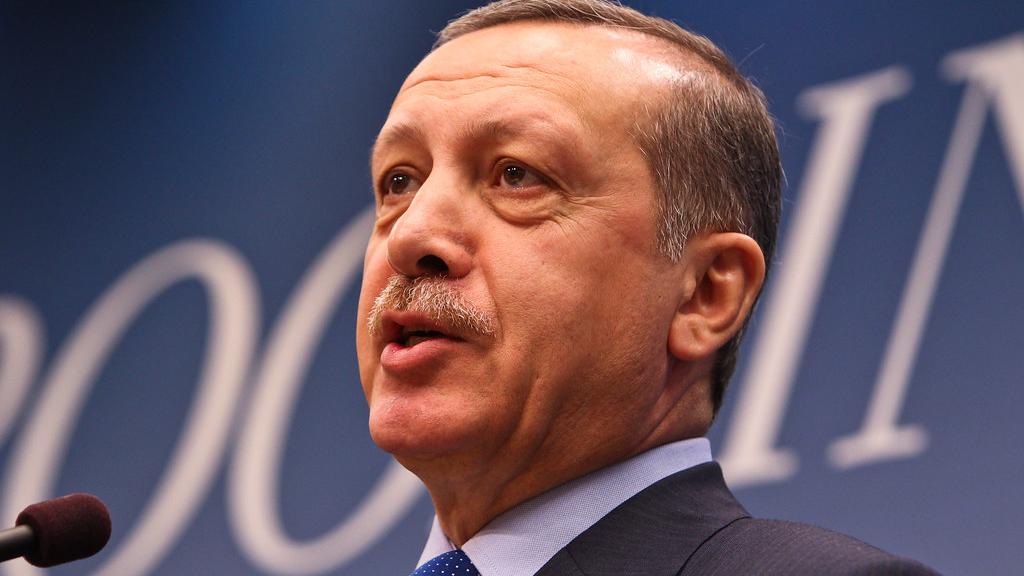

Turkey: Goodbye Erdoğan?

Since 2019, Turkish economic policy has been characterized by Erdoğan’s repeated U-turns. Initially, his regime adopted a programme based on low interest rates and credit expansion, breaking with neoliberal orthodoxy in order to consolidate political support among small and medium-sized enterprises (SMEs). This led to the devaluation of the Lira, high rates of inflation, a mounting current account deficit and external debt, thanks to Turkey’s high dependence on imports. In an attempt to counterbalance these effects, the government pivoted to a traditional neoliberal programme: high interest rates to attract foreign capital and stabilize the value of the TL, along with credit contraction to fight inflation and indebtedness. Yet, because such policies imperil the AKP’s electoral base, the party has continually reverted to a more heterodox approach – a back-and-forth oscillation that Ümit Akcay has analyzed in these pages.

As long as the Turkish economy was integrated into the transatlantic neoliberal order, there appeared to be no alternative to Erdoğan’s zigzagging. The strategic imperative to keep SMEs afloat by means of expansionary economic policies was irreconcilable with the country’s position in the world market. However, more recently, this oscillatory movement seems to have been abandoned in favor of a firm commitment to economic heterodoxy. Since spring 2021, the interest rates of the Central Bank (TCMB) have been pushed down to the extent that real interest rates are now far into negative territory (approaching minus 80% at their nadir). Conventional Lira deposits, held by the vast majority of the population, are yielding massive losses. Meanwhile, commercial and consumer credit has been massively expanded.

As expected, these measures allowed Turkey to attain high growth figures in 2021 – but at the cost of a massive devaluation of the Lira and skyrocketing inflation. High growth concealed a massive slump in living standards for the majority of the population, whose incomes did not keep pace with inflation despite compensatory measures such as hikes in the minimum wage, price controls and tax reductions. This dynamic led to an economic standstill towards the end of 2021, as businesses were unable to make sound price calculations and lost out on commercial contracts denominated in foreign exchange. A full-scale economic catastrophe was only narrowly avoided when Erdoğan announced what was essentially a state guarantee for foreign exchange-hedged deposits on 20 December 2021.

Shortly after that, the TCMB rolled out a so-called ‘liraization strategy’ which involved de facto foreign exchange control mechanisms: restricting access to TCMB loans for companies with high amounts of foreign exchange, banning the use of foreign exchange in domestic transactions, and creating incentives for banks to switch to TL deposits. This aimed to boost private sector demand for TL and keep devaluation at bay. But because there were no deep structural changes in the Turkish economy, all the ills of this heterodox approach – devaluation, high inflation, a high current account deficit – returned or persisted. This time, though, they were accompanied by rising interest and debt.

This gave rise to an even more fatal policy paradox. Over the course of 2022, Turkey began to experiment with a series of ‘macro-prudential measures’ to contain the crisis, such as de facto capital controls – economic penalties for banks that gave out loans with interest rates above 30% – to boost low-cost lending in TL to the private sector. However, as devaluation decelerated due to the liraization strategy, the inflation rate remained above the devaluation rate, because of the delayed effect of devaluation on inflation and the inflationary pressures emanating from the world economy. This, in turn, led to the effective appreciation of the TL.

In other words, Erdoğan’s policies ended up achieving the exact opposite of what they intended. Rather than deflating the price of export goods, they managed to raise it. Similarly, lower interest rates were accompanied by a massive deceleration of lending by private banks, which saw their profit margins shrink and scrambled to offset the effects of government policy. This was only offset by another rise in public lending in autumn 2022.

The Turkish economy therefore remains caught between a rock and a hard place. The AKP is reluctant to impose neoliberal remedies yet unable to formulate a viable alternative. With presidential and parliamentary elections scheduled for summer 2023 at the latest, the government’s hegemonic crisis is becoming more apparent. In this conjuncture, three distinct pathways have opened up: a mixture of improvisatory economic policies and authoritarian consolidation, favored by the government; a full-scale neoliberal restoration, favored by sections of capital and the main opposition; and a programme of popular-democratic reform, favored by the left.

Implicit in Erdoğan’s new policy approach was an ‘import-substitution industrialization’ strategy, in which the high costs of imports, combined with the low cost of financing investments and cost advantages due to devaluation and low interest rates, would foster industrial investment – giving Turkey a way out of its overreliance on the world market. Yet this ambition was never likely to be realized, since its success depended on a state-led planning and/or investment strategy that was always sorely lacking. It would thus be more accurate to characterize Turkey’s recent heterodox turn as yet another attempt at crisis management rather than a transition to a new regime of accumulation. Its purpose was to protect large sections of the population, especially those who work in SMEs, from the effects of economic freefall – buying time for the AKP until the next general election.

A return to orthodox neoliberal economic policy would entail much higher political costs than an approach that tries to mitigate the effects of the crisis on SMEs and domestic consumption by simply muddling through. The AKP’s current political strategy is to position itself as the only lifeline for struggling small businesses while ramping up repression against potential threats to its hegemony. But this is not a foolproof method. For instance, high-performing SMEs that feel they can withstand the competitive pressures of an orthodox monetary policy may choose to ally with capitalists calling for an expansion of Turkey’s role in the global economy. Indeed, the factions of capital that are closest to the AKP – mostly export-oriented with lower import-dependency – have already begun to criticize the government for its botched currency devaluation.

So far, there has not been a decisive break between the leading factions of capital and the Erdoğan regime; most sectors are still returning high profits (banks have seen a whopping fivefold increase), thanks partly to wage suppression caused by inflation. But the country’s leading business association, the Turkish Industry and Business Association (TÜSIAD), is becoming increasingly vocal in its demand to reimpose neoliberal policies, with the ultimate aim of increasing Turkey’s centrality in international production chains. It also advocates a shift away from AKP authoritarianism towards a model with more civil liberties and constitutional balances, so as to curtail what it sees as the socially destabilizing effects of the current system.

As the AKP’s interests have steadily diverged from those of big capital, the struggle between the regime and its political rivals has also come to a head. Polls show that the public mood had turned against the governing party, with its victory in the next election far from guaranteed. This has prompted the opposition bloc, led by the Republican People’s Party (CHP), to go on the offensive. More often than not, this means trying to outflank Erdoğan and his allies on Turkish nationalism and chauvinism. The opposition, should it come to power, has promised the persecution and repatriation of Syrian refugees along with a full-scale war on the PKK. Its would-be Economy Minister, Ali Babacan, has vowed to continue outlawing strikes. And the bloc has remained firmly against any form of popular mobilization. As CHP leader Kemal Kılıçdaroğlu asserted, ‘Active opposition is one thing, taking to the streets is another…We have only one wish, that our people should remain as calm as possible, at least until elections come.’

The opposition’s goal is to re-establish the neoliberal regime on an expanded scale, purged of its current hyper-presidential structure yet incorporating some of the authoritarian and nationalist ideological elements associated with the AKP and its predecessors, while continuing to demobilize and depoliticize the population. This will be the trade-off for any small degree of democratic reform.

Can such a vision, uninspiring as it is, succeed in galvanizing the electorate to kick out the incumbent? Polls suggest a high level of disaffection with the government, but also skepticism concerning the opposition. Erdoğan, despite his various missteps, has been adept at maintaining the identitarian connection between his party and its base – which, combined with his short-term populist and redistributionary programme (including subsidies for household bills, further wage increases, social housing and state-led credit programmes for SMEs), may be enough to keep him in power. The most recent polls show an uptick for the AKP following the announcement of such measures.

No matter who wins the next election, though, there remains an alternative for Turkey beyond authoritarian consolidation and neoliberal restoration. It lies in new outfits such as the Labour and Freedom Alliance (Emek ve Özgürlük İttifakı), a coalition of pro-Kurdish and leftist parties which aims to unify these dissident forces. For them, the only route out of the national crisis is a coherent, democratically-accountable economic strategy that fundamentally alters the Turkish model in favor of the popular classes, along with far-reaching political reform. Their attempts to organize in an increasingly repressive climate will be an uphill battle, but unless it is fought, the prospect of democratizing Turkey will vanish entirely.