Marxist crisis theory: Why capitalism fails

First published at Tempest.

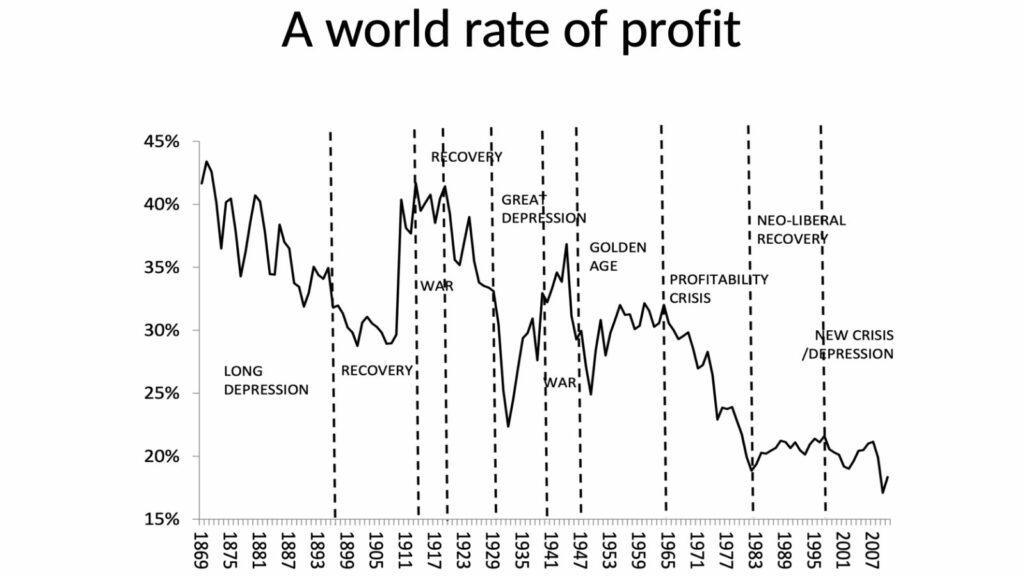

There is little debate among mainstream, radical, and Marxian economists that periodic crises mark the history of capitalism. In the US and globally, at least forty recessions and depressions, lasting six to eight years on average, have occurred since the early nineteenth century. Each of these cycles is marked by a three-to-four-year boom in investment and production, followed by a contraction in output and investment and a wave of business bankruptcies. In addition to these cycles, there have been at least four long periods of accumulation—1869-1914, 1914-1965, 1965-1983, and 1982-2008.

Each of these long, accumulative waves was marked by twenty to twenty-five years of contractions, where recessions were deep and recoveries weak; and twenty to twenty-five years of expansion, where recessions were weak and recoveries strong. There is a general consensus that the capitalist world economy entered a new long period of stagnation and contraction around 2007-2008.

However, there is little agreement about the causes and consequences of this recurring economic turbulence. Mainstream economists insist that the “market economy” (their euphemism for capitalism) should produce smooth and steady growth. Recessions and long-term crises are the result of unexpected and unpredictable “shocks” to the economy. Radical and Marxian economists, on the other hand, argue that economic downturns are a necessary feature of capitalism. As Anwar Shaik argues, crises are “an absolutely normal phase of a long-standing recurrent pattern of capitalist accumulation in which long booms eventually give way to long downturns.”

Although radical and Marxian economists agree that capitalism is subject to periodic crises, there is no consensus on what causes crises. Today, most radical economists claim that the root of capitalist crisis is not located in the production process, but in the absence of “effective demand”—they are crises of “under-consumption.” In the 1970s and 1980s, most critical economists saw crises rooted in the struggle between capital and labor over wages and profits. These “profit-squeeze” theorists argued that some combination of wage increases or workers’ successful resistance to speed-up and deskilling led to declining labor-productivity in the 1960s, reducing profits and sparking the global crisis of that era. Finally, the defenders of Marx’s theory of the falling rate of profit argue that crises are a necessary result of the competitively driven process of capitalist accumulation.

For many on the Left, these debates appear to be abstract, academic disputes with little relevance to political practice. In reality, different socialist strategies rest, implicitly or explicitly, on different crisis theories. This talk will review the three main radical and Marxian theories—under-consumption, profit squeeze, and the falling rate of profit-to determine their theoretical consistency, factual accuracy and political implications. While there is no one-to-one correspondence between a crisis theory and political strategy, under-consumption and profit-squeeze arguments are generally associated with reformist, social-democratic politics. However, revolutionaries have also embraced these theories. We will focus on how each theory crisis defines not merely causes, but a range of possible resolutions of the crisis which then defines the concrete program a radical Left should fight for, and the social forces we rely upon.

Underconsumption

Before the 1970s—and again since the 2007-2008 recession—the dominant crisis theory on the US and global Left is one or another variant of under-consumption. Economists associated with the US Communist Party, the Monthly Review school of Baran, Sweezy and John Bellamy Foster, the AFL-CIO aligned Economic Policy Institute, the Democratic Party liberal Paul Krugman and the “post-modern Marxist” Richard Wolf all argue that recurrent economic crises are the result of capitalism’s lack of any internal mechanism to generate demand sufficient to buy-back a growing supply of goods and services. In its simplest form, the fact that workers are paid a wage that is less than the value of what they produce is said to give rise to a gap between demand and supply. Under-consumption theories, like the profit-squeeze arguments, appeal to many on the anti-capitalist Left because the make the relationship of class forces the root cause of capitalist crisis. As capitalists pursue the greatest profits by restraining wages, they actually destroy the markets for their output, leading to crises.

The revolutionary socialist Rosa Luxemburg argued that the inability of capitalist to sell their goods at “home” compels them to seek “external markets” abroad for their excess supply. She concluded that once the entire world became capitalist, the inability to find markets for goods and services would lead to the collapse of capitalism. Nevertheless, under-consumption theories of crises are usually mobilized to support the creation of a “regulated capitalism.” Many proponents of the theory argue that the “golden age” of capitalism from 1940 to 1975 overcame the problem of ‘insufficient demand” through capitalist state policies that redistributed income to workers and provided incentives for capitalist investment. Today they argue that a coalition of union officials, social movement leaders, and “progressive” politicians like those who lead European social-democratic parties or the US Democratic Party can secure a new “win-win” solution to the crisis that would raise living standards for workers and increase profitability for capitalists. Put simply, under-consumption theories generally support the reformist claim that capitalist crises can be avoided if the state, as a “neutral arbiter,” can successfully balance the interests of capital and labor—balancing supply and demand.

Under-consumption theories rest on a fundamentally false assumption about capitalism—that capitalists produce only consumer goods, and the only “market” for consumer goods are the workers who produce them. In reality, however, capitalists produce both consumer and capital goods—machinery, buildings, raw materials and the like. Workers employed in an expanding consumer and capital goods sector can earn enough to buy the output of the consumer goods sector; while capitalists in both the consumer and capital goods sector can spend enough to buy the output of the capital goods sector. As long as capitalists in both the capital and consumer goods sectors are investing, supply and demand can be turbulently regulated, leading to short-term business cycles rather than long periods of growth and stagnation. Continued investment—capital accumulation—ultimately depends upon rising profits. When profits fall, investment slacks, employment drops, and demand for both consumer and capital goods drops—leading to “over-production.” Put simply, “under-consumption” is the result, not the cause, of falling profits.

There is considerable empirical evidence to challenge the notion that insufficient demand causes crises. Most economists recognize that capitalist firms adjust to fluctuations in demand by adjusting capacity utilization—increasing or reducing the number of workers through the addition or elimination of work shifts. Shaikh has developed a statistical method to adjust profit rate data for capacity utilization. He found that profits, even when adjusted for capacity utilization—fluctuations in demand—still fall periodically. Michael Roberts has examined the relationship between fluctuations in consumption, investment and total output in six cyclical downturns since the 1950s. In each the primary driver of the decline in output is not changes in consumption, but sharp drops in profit-driven investment. In fact, during the 1980-1982 recession, consumption grew around one percent, while investment dropped over ten percent leading to a nearly one percent drop in output.

Profit-squeeze

During the last long crisis of profitability of the late 1960s and 1970s, the profit-squeeze became the dominant left-wing explanation of the decline of profitability and accumulation across the capitalist world. Today few claim that the increased strength of workers—who have suffered nearly continuous defeats since the early 1980s—has caused the current crisis. However, in the late 1960s and early 1970s, a number of radical economists argued that the increasing strength of workers, the result of wild-cat strikes and other workplace struggles, caused a sharp and general fall in profits in all of the industrial capitalist societies. Two revolutionary socialists, Andrew Glyn and Bob Sutcliff, were the first to argue that rising workers’ wages in the late 1960s led to a decline in capitalist profitability in the early 1970s. By the 1980s, three left social-democrats, Sam Bowles, David Gordon, and Tom Weiskopf, took up this argument, claiming that the ability of workers to raise wages, win broad social reforms that partially “de-commodified” labor-power, and blocked corporate attempts to reorganize the labor process was the primary cause of the crisis. Workers’ struggles led to a declining rate of growth of labor productivity, rising costs of maintaining capitalist control over workers in production, and a rising “social wage” (social welfare payments), all of which squeezed corporate profits.

Like under-consumption theories, profit-squeeze theories appealed to many anti-capitalists and socialists because they made class power— in this case, the strength of labor—the key determinant of profitability. However, making class struggle the central determinant of profitability actually led to a politics of class collaboration. Gordon, Bowles and Weiskopf were important proponents of workplace “co-management” and “labor-management cooperation.” They claimed that these experiments in “work-place democracy” would raise productivity, allowing both capitalists’ profits and workers’ living and working conditions to improve simultaneously. Many advocates of this solution to the crisis argued that “workplace democracy” could be won by an alliance of labor officials and liberal Democrats. As Jane Slaughter, Mike Parker, Kim Moody and others have demonstrated, such experiments in labor-management cooperation have been, at best, a cover for the introduction and spread of lean production—weakening unions and fragmenting and intensifying work across the capitalist economy.

Logically and theoretically, rising wages or declining worker efforts can only reduce profits for short periods of time and only in certain branches of production. Capitalists in a particular industry can respond to rising wages or declining worker effort through either the introduction of new and more productive machinery; or, if this is not immediately possible, by diverting new investment into industries where wages are lower, worker effort more intense and profits higher. Put simply, neither rising wages nor declining worker effort can lead to a general and prolonged crisis of profitability like that of the 1960s and 1970s. Data also challenges the “profit squeeze” argument. The rate of growth of productivity began to fall in the mid-1960s—well before the upsurge of worker militancy—as the result of falling capital investment. The fall in capital investment was a response to falling profit. Put simply, the slowdown of productivity growth was an effect, not the cause of the onset of the crisis in the mid-1960s.

The falling rate of profit

Marx put forward the theory of the law of the tendency of the rate of profit to fall in the third volume of Capital, which was first published in 1894. However, most Marxists in both the Second and Third Internationals ignored the theory until 1929, when Henryk Grossman published his groundbreaking The Law of Accumulation. Today, Anwar Shaikh and Michael Roberts are among its best-known advocates. The theory roots crises in the same mechanisms that produce capitalism’s dynamism—accumulation and competition. For capitalists, real competition compels them to constantly reduce cost per unit output in relation to other capitalists. Capitalists, in order to survive the competitive war of all against all, not only have to reduce wage costs, but must also constantly reorganize work to increase labor-productivity—the rate of exploitation. Capitalists increase exploitation through both the fragmentation and routinization of tasks, and, crucially through the mechanization of the production process. Capitalism necessarily leads to debilitating, alienating work; constant pressure to cut wages and speed up the pace of work; and the replacement of workers with machines.

At the center of Marx’s theory of crisis is the increasing capitalization of production—or rising organic composition of capital.

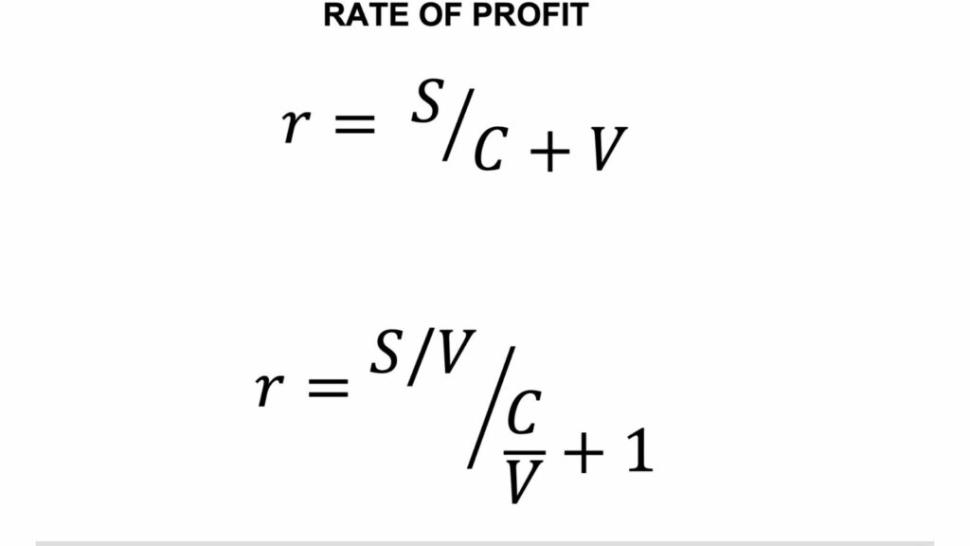

The rate of profit can be expressed as a simple fraction. The numerator of the fraction is the total amount of unpaid labor—surplus-value (S)—pumped out of working people. The fraction’s denominator is the capitalists’ investment costs in buildings, machinery and raw materials—constant capital (C) — and wages – variable capital (V). We can also view the rate of profit as the relationship between the amount of surplus value produced comapared to wages—the rate of exploitation (S/V)—and the relationship between constant capital and variable capital—the organic composition of capital (C/V). This formula allows us to grasp the relationship between the rate of exploitation and the organic composition of capital. The higher the rate of exploitation and the lower the organic composition of capital, the higher the rate of profit. The lower the rate of exploitation, and the higher the organic composition of capital, the lower the rate of profit. When the organic composition of capital rises more quickly than the rate of exploitation the rate of profit will fall. If the rate of exploitation rises more quickly than the organic composition of capital—as the result of massive bankruptcies that destroy inefficient constant capital combined with increasing work-intensity and lowering of wages—the rate of profit will rise. Put simply, capitalist accumulation and competition produce both the tendency of the rate of profit to fall and its counter-tendency—both crises and recoveries.

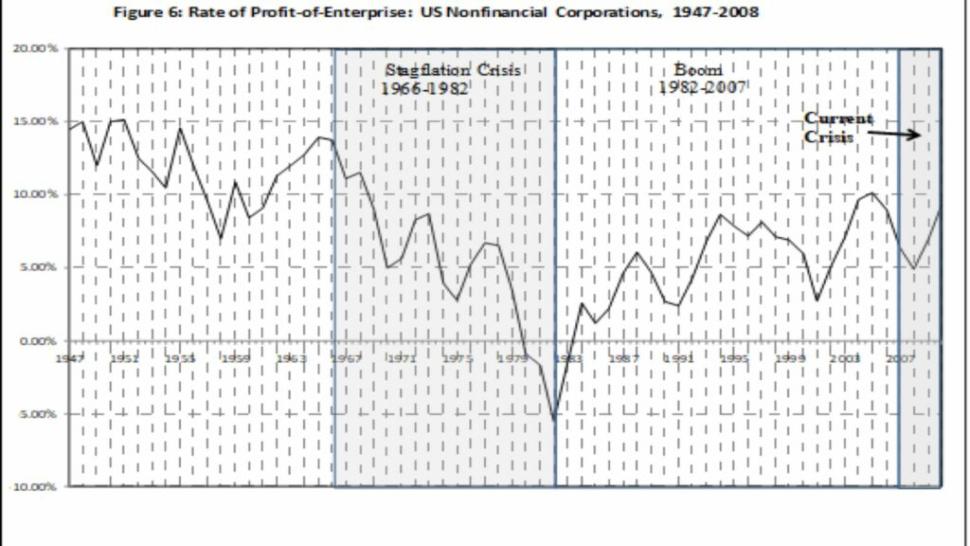

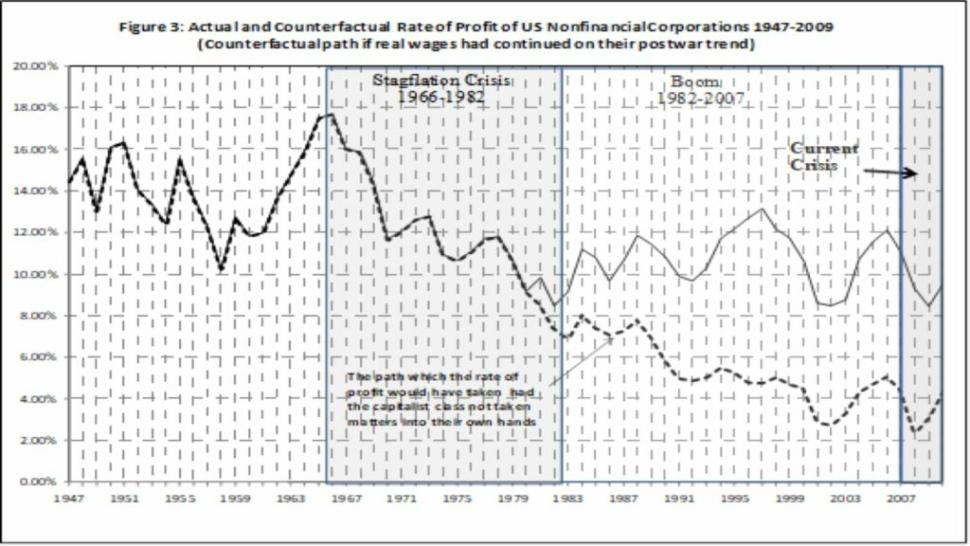

Both Roberts and Shaikh have constructed measures of the rate of profit. Shaikh plots the movements of the Rate of Profit of Enterprise for US Nonfinancial Corporations from 1947-2007.

The general rate of profit is the measured gross of monetary profit minus interest paid divided by the capital stock. The rate of profit of enterprise is the general rate of profit minus the rate of interest. According to Shaikh, the rate of profit of enterprise “is the central drive of accumulation, the material foundation of the ‘animal spirits’ of industrial capital.” It is the average rate of profit capitalists earn from productive investment—rather than investing in financial instruments. We can see three distinct phases of the movement of profitability since the Second World War. The first phase, from 1947-1966 was the post-war boom, which saw a relatively stable rate of profit of enterprise. The second phase, from 1966-1982 was the “Stagflation Crisis,” with a sharp decline in the rate of profit of enterprise, falling from 14 percent in 1966 to -5 percent in 1982. The third was the “neo-liberal boom” of 1982-2007, characterized by a sharp increase in the rate of profit of enterprise, from a low of-5 percent in 1982 to 10 percent in 2005.

Three factors ended the “Stagflation Crisis” and sustained the “Neo-Liberal boom.” The first were two waves of bankruptcies—the initial destruction of less efficient and less profitable firms during the recession of 1980-82, followed by waves of corporate reorganizations and mergers and acquisitions over the next decade which shuttered older, less competitive and profitable operations. These bankruptcies and corporate reorganization reduced the value of the capital-stock—devalorizing constant capital and reducing the organic composition of capital, the denominator of the rate of profit. The scale of the devalorization of constant capital in the 1980s paled in comparison to that of the Great Depression of the 1930s. Not surprisingly, the neo-liberal boom was not anywhere near as vibrant as the post-war expansion. Instead, the wave of bankruptcies in the 1980s were on a similar scale to those during the “long depression” of the 1870s and 1880s, which produced the less dynamic long expansion of 1894–1914. The second factor was the exceedingly low interest rates in the US and globally after c. 1983, that sustained the rate of profit on enterprise until 2008.

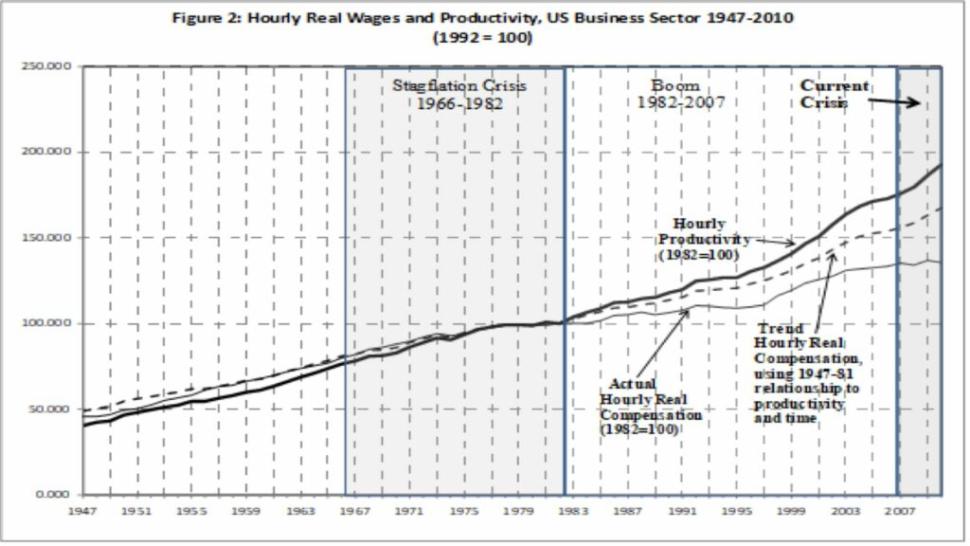

Finally, a depression of wage increases and a radical increase in the labor productivity raised the numerator of the rate of profit. Shaikh’s establishes that hourly productivity (the rate of exploitation) rose sharply in the neoliberal era, while real wages were either stagnant (until 1997) or lagged far behind the increased rate of exploitation. He also demonstrates that if capital had not “taken matters into their own hands”—keeping wages and wage increases below the increase in the rate of exploitation—the rate of profit would have continued to fall after 1982. Instead, the increased rate of exploitation sustained a rising rate of profit during the neoliberal boom.

Most of us are familiar with the main ways that capitalists increased the rate of exploitation over the past four decades. On the one hand, the employers’ offensive saw renewed union-busting, the spread of two-tier wage and benefit systems. On the other, it introduced radical changes in work-rules which allowed the generalization of what Moody and others have called lean production – division and simplification of tasks, multi-tasking, reduction and elimination of breaks, speed-up, and other measures to “squeeze the pores out of the working day.” Lean production allowed capitalists to raise output per hour (rate of exploitation) while keeping real wages stagnant or rising at a slower rate than productivity.

Another factor reducing wages and increasing the rate of surplus-value was the creation of global production chains—what is generally called “globalization.” We should remember that 75 percent of global investment remains within the country of origin, and 70 percent of foreign direct investment flows from one industrialized country to another. For example, when Ford or General Motors invests, three-quarters of their investments are in the US, and seven-tenths of their overseas investments are in Western Europe, Canada, Australia and Japan. Most of the fifteen to twenty percent of global investment that flows from the global north to the global south is concentrated in the more labor-intensive, wage sensitive parts of production, for example auto parts and electronic components. These operations were moved to the global south to take advantage of lower wages—ensuring a rising rate of exploitation in the core of the world-economy. As during the imperialist expansion before the First World War, imperialist investment in low organic composition of capital industries in the global South raised profitability across the globe.

The long wave of expansion that began in the mid-1980s was not—and could not be permanent. As profits rose, capitalist accumulation began anew. The resulting increasing capitalization of production led to declining rates of profit, and eventually a stagnation in the mass of profits. The capitalist world entered a long wave of stagnation in 2007-2008 from which it is yet to emerge. This period is marked by lower profits on new investment in the face of productive overcapacity, resulting in longer and deeper recessions. It is this new economic context that makes financial meltdowns, like the collapse of cryptocurrencies or the Silicon Valley Bank, so dangerous for capital. Financial crises rooted in increased investment in “fictitious capital”—claims on future wealth—is a feature of the peak of every business cycle. If the underlying conditions of profitability and accumulation are healthy for capital, then financial crises are relatively mild and lead to a new cycle of strong growth. This was the case with the stock market crash of 1987, the savings and loan crisis of the early 1990s, and the “dot.com bubble” of the first decade of this century. However, when the underlying conditions of profitability and accumulation are unhealthy for capital—as they are today—financial crises carry with them much greater risks.

Capitalist state bailouts of the financial system have, so far, prevented a total collapse of the financial system and a new 1930s style depression. However, preventing financial collapse—especially when combined with state ‘industrial policy’ that provide incentives for investment in manufacturing—allows the survival of non-competitive, “zombie capitals” and prolongs the crisis of profitability. Not only do cyclical recoveries remain anemic, but the infusion of money into the economy through policies to stimulate investment and consumption fuel inflation in a period of low profitability. The end of the “COVID recession” saw a return of the stagflation that plagued the capitalist world in the late 1960s and 1970s. The managers of the capitalist state, whether Democrats or Republicans, will attempt to walk a fine line between the political imperatives of reviving US industrial and military competitiveness (what has become a feature of “Bidenomics”) and maintaining employment, on the one hand; and the need to “tame inflation” to discipline both capitalists and workers and restore profitability on the other.

The political implications of the theory of the falling rate of profit are profound. Capitalist state policies, under any government whether of the “left” or “right,” cannot engineer a “win-win” solution to the crisis that simultaneously maintains employment, wages and working conditions and the conditions for profitable and competitive accumulation. Socialists engaged in any and all struggles that challenge capital—whether for better wages and working conditions, to expand social spending, and to build a mass challenge to the rising tide of attacks on people of color, immigrants, women and queer folks—need to understand that there are no “win-win” solutions to these struggles. Only independent, mass and militant movements of working people—capable and willing to engage in massive social disruption, in particular disruptions of production—will be able to stop the renewed capitalist offensive. The inability of the forces of official reformism (labor officials, middle class leaders of women, queers and people of color, liberal politicians) to organize these sorts of struggles is what has led them to abandon the struggle for reform. As we have seen time and time again, we cannot rely on these forces to organize a struggle to defend the existing gains of working and oppressed people, no less traverse the only road out of the long roller coaster of capitalist expansion and crisis—the revolutionary abolition of capitalism. Only a self-organized and militant working-class movement will be capable of defending past gains and ultimately replacing the current social order with a democratic and collectivist society—socialism.

Suggested Readings:

Henryk Grossman, The Law of Accumulation and Breakdown of the Capitalist System, Being Also a Theory of Crisis, (Haymarket Books, 2022).

Michael Roberts, The Long Depression: Marxism and the Global Crisis of Capitalism (Haymarket Books, 2016).

Michael Roberts Blog: Blogging from A Marxist Economist.

Anwar Shaikh, “An Introduction to the History of Crisis Theories” in US Capitalism in Crisis (Union of Radical Political Economics, 1978).

Charlie Post teaches sociology at the City University of New York. He is an editor of Spectre: A Marxist Journal and a member of the Tempest Collective.