economics

Reimagining socialism: An interview with David Kotz

David Kotz dissects the lessons from the Soviet model, explains why capitalism cannot be reformed and makes a case for democratic socialism.

The Nobel Prize for Institutions: A critique of Acemoglu and Robinson’s framework

Dmitry Pozhidaev — In many ways, Acemoglu and Robinson’s framework echoes the “end of history” thesis popularised by Francis Fukuyama.

Imperialism as antagonistic cooperation

Promise Li — Economic interdependence has shown surprising resilience even across rival geopolitical blocs. Existing theories of imperialism fail to fully account for these seemingly contradictory dimensions of today’s world system.

State of the world: Economic crisis and geopolitical rivalries

Claude Serfati — The global space is being transformed under the dual pressure of economic dynamics and geopolitical rivalries.

Imperialism: Now we have some numbers

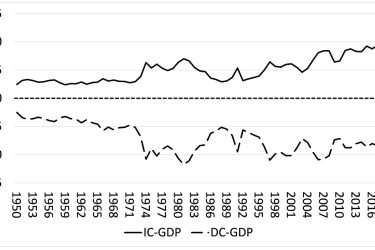

Renfrey Clarke — In the view of Marxists, the rift that divides the world is a direct result of imperialism, whose core is always material and economic.

Bangladesh: The ‘Global South’ debt crisis intensifies

Michael Roberts — The overthrow of the Sheikh Hasina’s dictatorial government in Bangladesh is a startling outcome of the economic nightmare that many so-called developing economies are experiencing.

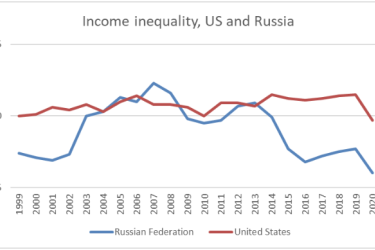

Russia’s delinking from the West: The great equalizer

Dmitry Pozhidaev — In combination with growing state capitalism and the war economy, Russia’s delinking has created additional internal investment opportunities and fiscal space for income redistribution.

Prelude to a new imperial order?

Todd Gordon & Jeffery R Webber — The immediacy of the Russian invasion of Ukraine alongside the emergence of China as a potential global power has changed the debate on imperialism.

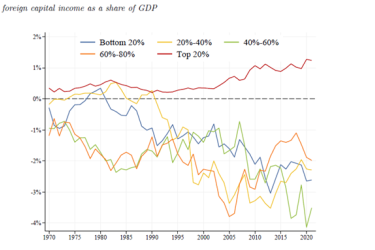

Michael Roberts: Further thoughts on the economics of imperialism

Michael Roberts — Imperialism can be quantified in economic terms: it is the persistent transfer of surplus value to the rich countries from the poorest countries of the world. This process developed some 150 years or so ago and remains.

Why ‘developing countries’ are trapped in a new debt crisis

Eric Toussaint — The World Bank report on the debts of “developing countries,” published on December 13, 2023, reveals an alarming fact: in 2022, developing countries as a whole spent a record US$443.5 billion to pay for their external public debt.