economics

Behind Trump’s spiralling tariff war: An interview with Marxist economist Michael Roberts

Michael Roberts explains the recent raft of tariffs announced by US President Donald Trump, how they fit into his broader project to reassert US global hegemony, and what a left response could look like.

From welfare to warfare: military Keynesianism

Michael Roberts — Keynesianism advocates digging holes and filling them up to create jobs. Military Keynesianism advocates digging graves and filling them with bodies to create jobs.

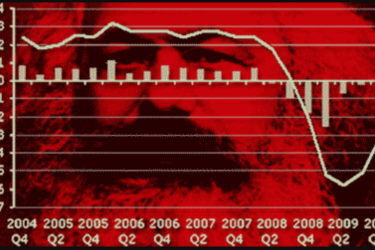

Marx was wrong about the declining rate of profit. Isn’t it time we put this false idea to rest?

James Doughney — Careful attention to Marx’s exposition of the theory of the declining rate of profit demonstrates that his theory is not coherent, even in its own terms.

The epochal crisis of global capitalism — Challenges for popular resistance from below

William I Robinson — Faced with an unprecedented crisis of epochal proportions, global capitalism’s extermination impulse is rising to the surface. Never has the slogan “resist to exist” been more opportune and appropriate.

Serbia in 2024: A mirror on capitalism’s global crises

Dmitry Pozhidaev — In 2024, Serbia offered a particularly clear reflection of the three core dimensions of capitalism’s crisis: political, economic and systemic.

Reimagining socialism: An interview with David Kotz

David Kotz dissects the lessons from the Soviet model, explains why capitalism cannot be reformed and makes a case for democratic socialism.

The Nobel Prize for Institutions: A critique of Acemoglu and Robinson’s framework

Dmitry Pozhidaev — In many ways, Acemoglu and Robinson’s framework echoes the “end of history” thesis popularised by Francis Fukuyama.

Imperialism as antagonistic cooperation

Promise Li — Economic interdependence has shown surprising resilience even across rival geopolitical blocs. Existing theories of imperialism fail to fully account for these seemingly contradictory dimensions of today’s world system.

State of the world: Economic crisis and geopolitical rivalries

Claude Serfati — The global space is being transformed under the dual pressure of economic dynamics and geopolitical rivalries.